Smart Follow

Specialty Lines

Real Time

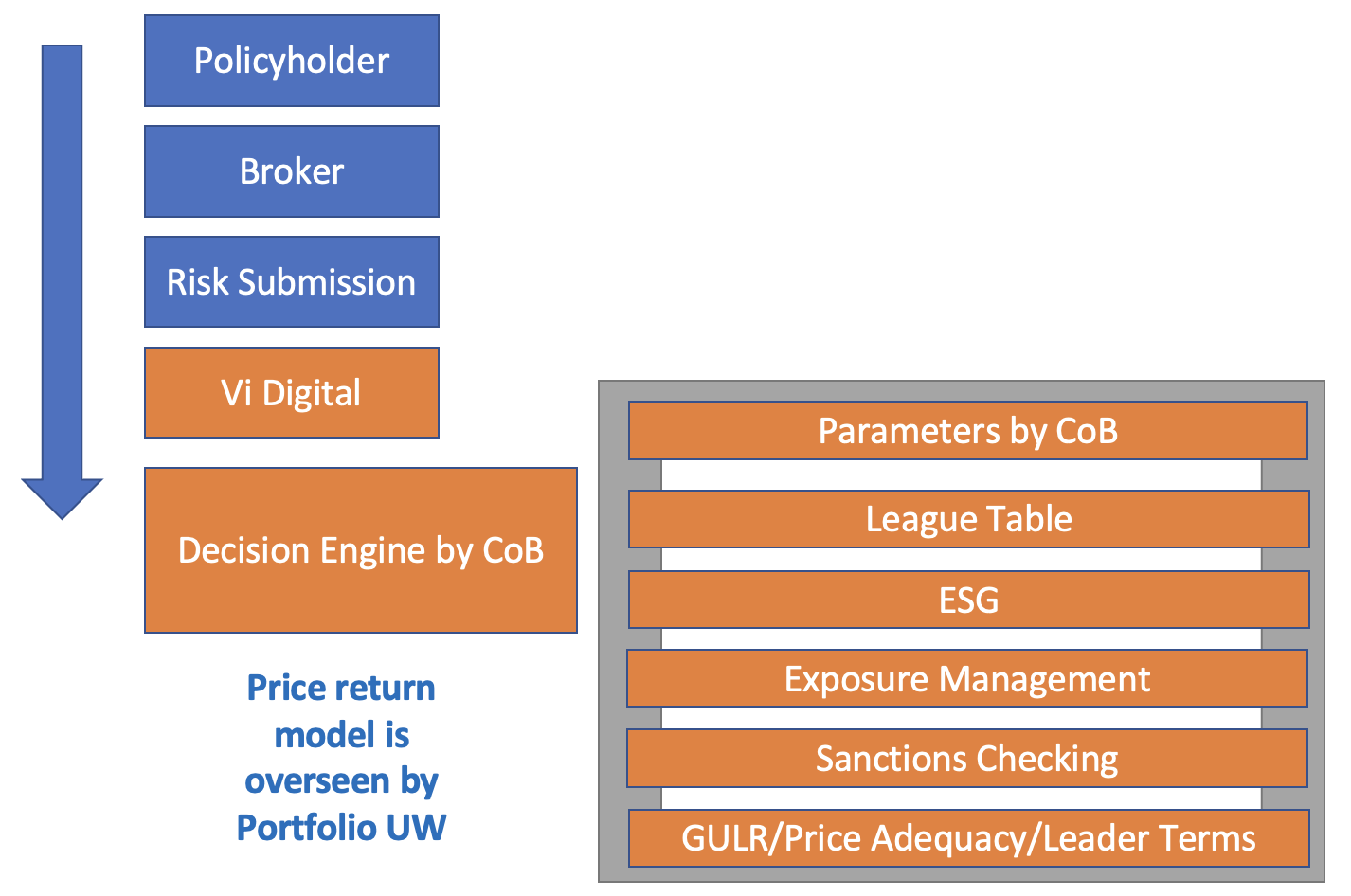

Real-time risk controls with prebind checks, robust security and data capture

Data Driven

Algorithm driven platform takes decisions based on transparent modifiable criteria

Scaleable

Highly scaleable model permits considerable savings and best in class expense ratio

ESG

Sustainability is integrated in the decision engine reflecting our desire to help forge a better world

Smart players are making bold moves with great positioning: reallocating capital and focusing on areas where they can scale, investing for growth and innovation, and improving productivity

– Henri de Combles de Nayves, McKinsey Partner covering Insurance, paraphrased

The future of digital insurance

Digital end to end specialty lines insurance reduces operating costs by up to 60% at scale; it eliminates double data entry and ensures a single source of truth.

Data driven machine learning helps an underwriter outperform while permitting a detailed real-time picture of risk and adapting to market feedback…

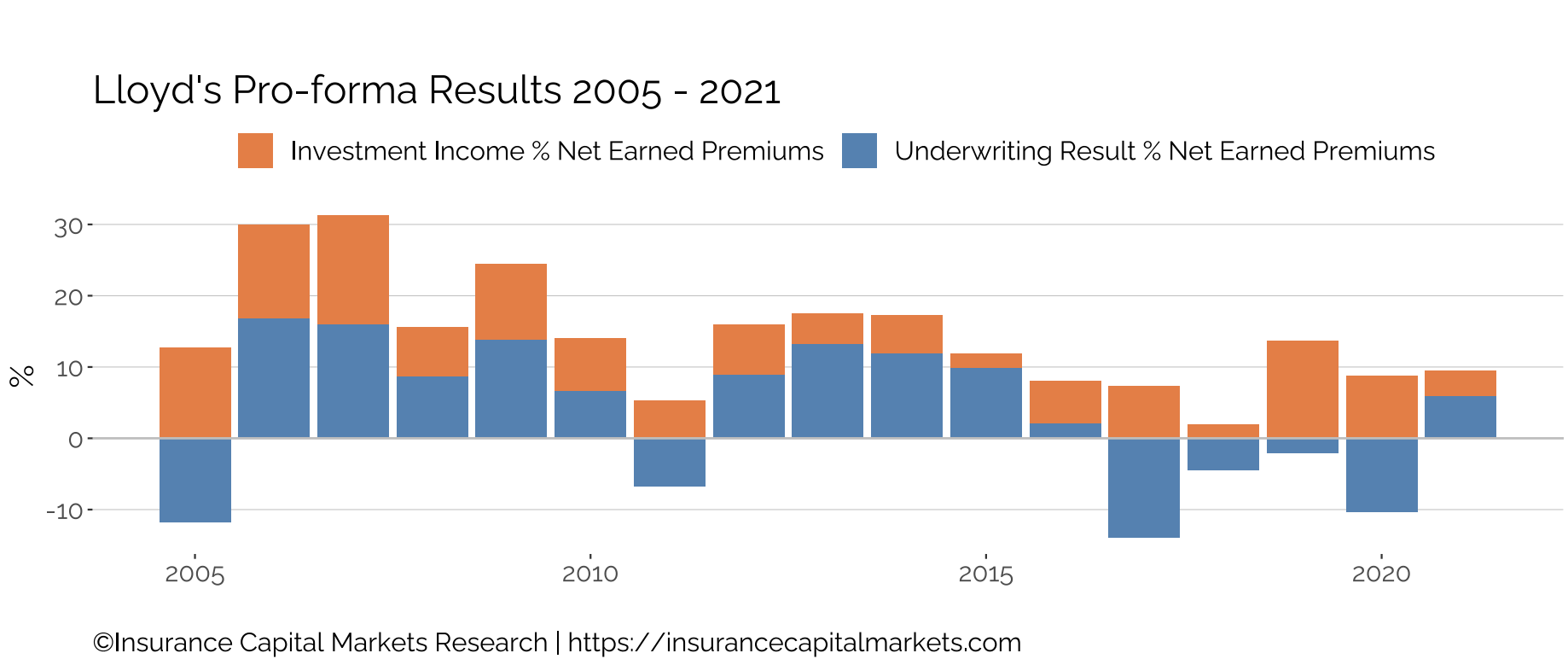

Portfolio diversification and low volatility

By focussing on a broad diversification with a portfolio perspective, the follow market is able to emphasise its key advantage of reducing cost and achieve low volatility growth across the cycle.

over 65%

of Lloyd’s Specialty Lines is follow market

Our Mission Is to Build the Foundation of a Secure Future

The Lloyd’s specialty lines are expected to exceed £56bn+ GWP in 2023

Future

Address

20 St Andrew Street

London EC4A 3AG

contact@visyndicate.com